Medicare's IRMAA impacts every retirement plan, learning how to mitigate it is only available via IRMAA Certified Planners designation

While everyone else is having the same conversations, you can now offer solutions to more people and solve real problems.

Our certification educates you in the most overlooked piece of financial planning:

18 modules teaching you everything you need to know aboutMedicares’ IRMAA and it’s impact on Social Security

Learn sound investment decisions that show which assets help mitigate IRMAA

Use our course as a platform to enhance your career as financial professional

Learn at your own speed – you have up to 12 months to complete the course

Listen to Hugh McDonalds Success

We Don't Like to Brag,

So We Will Let Others Do It For Us.

“The IRMAA Solutions certification program was not only an eye opener but a game changer. The unknown things in life are what cause the most pain, IRMAA is one of those hidden pains. The TRUE cost of the IRMAA surcharge plus medical expenses are unknown by most advisors and dismissed by others is concerning.”

Mark Clark

Prestige Planning - Managing Partner CFP CKA

“The Certified IRMAA program will separate you from other advisors by giving you the practice management knowledge of Medicare and its costs to my clientele. The topic of IRMAA has opened my eyes on how the majority of Pre Retirees/Retirees in America know very little to nothing about the risk. Would highly recommend every advisor take this course.”

John McEachran

LifeMark Securities - Registered Representative

“What an AMAZING IRMAA education. I have been a life insurance agent since I was 28 years old, and have always worked with safe money concepts. The IRMAA Certified Professional Course has now opened a World of clients to me. If you are looking for a way to stand out from the crowd, then this course is a must! It is the best money I have ever spent in my business career!!!”

Ira Kleban

Certified Planner

What Would You Do?

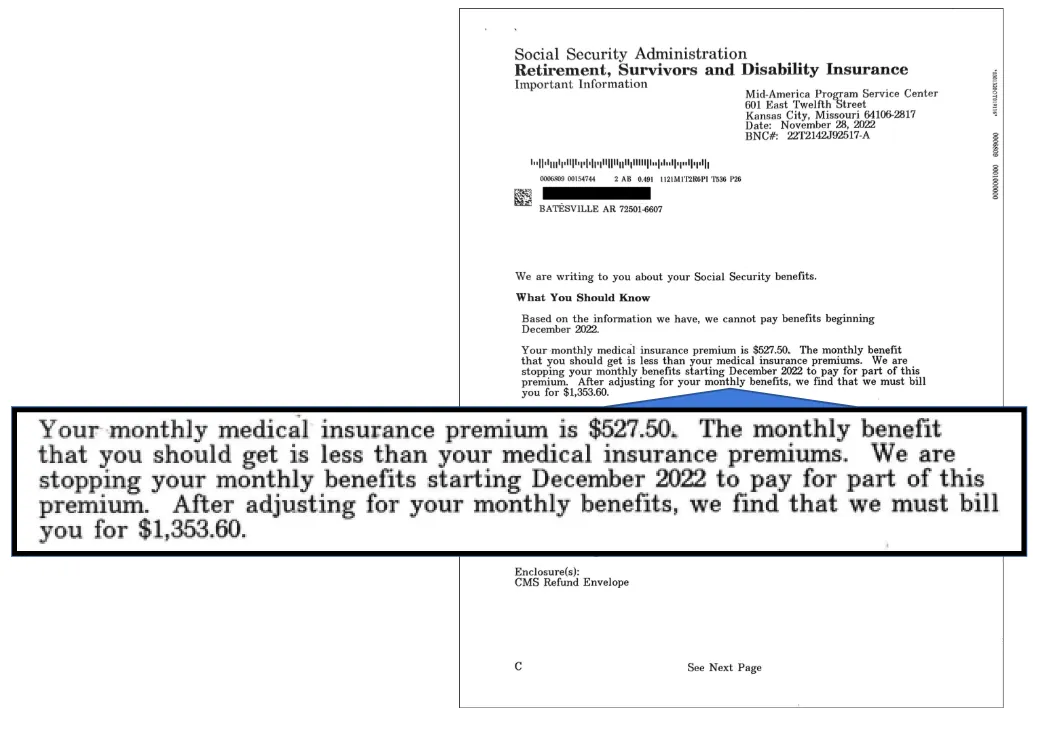

...if a client of yours handed you this letter to them from Social Security Administration

Becoming an IRMAA Certified Planner helps you navigate items like the one above and more.

Dan Mcgrath

Dan McGrath is one of the nation’s leading authorities on how the costs associated to health care are impacting investors’ retirement and Social Security benefits. He is the best-selling retirement planning author of “What you don’t know about retirement will hurt you,” as well as authoring on an annual basis, “A Guide to Understanding Medicare.” Currently he is one of the Co-Founders of IRMAA Certified Planner whose main responsibility is creating and designing the content of its IRMAA certification.

How It Works

IRMAA Education

Internet accessible,

self paced study that covers all the parts and pieces of Medicare, Social Security and IRMAA

Testing

Once self study has been completed, accessing the online final exam.

On Going support and learning

Access to Advanced learning webinars with other industry professionals

More Testimonials

“Having taken Certification courses and Designations through the College for Financial Planning, The American College, LOMA and a handful of others, I have yet to have found a curriculum with more practically useful information than the IRMAA Certified Planner course has offered me.”

Edward Petersmarck

M & O Marketing - Vice President of Practice Development WMS, NSSA, ALMI

“The IRMAA Course was an eye opener for my practice. This is not your typical certification for the record. By learning about IRMAA, I've been able to share the risk of IRMAA with several Estate Planning Attorney partners of mine. IRMAA is a serious topic that is not being discussed in America.”

Michael Fox

Lifemark Securitites - Registered Representative

Course Pricing

Non Promotional Price: $695

Limited Time Certification and 8 CE Credit Bundle

Order now using the link below and get both 8 CE credits along with the IRMAACP (IRMAA Certified Planner) Designation for:

$499

Why Should I get Certified?

Our program is designed to provide the highest level of education so you, as a Financial Advisor would understand the risks of IRMAA in every scenario for your clients, as well as ways to prevent and even solutions to appeal if the client is already affected.With the certification program, you will get:

Virtual Education

Certificate of Completion

IRMAA Certified Planner Certificate

I would like to know more about this program, where should I go?

To learn more about the course, you can go to the course certification page or you can use the contact form below.

Will I be listed on the IRMAACP website?

Once you have completed the course and successfully passed the exam, you will be listed on the IRMAACP online directory. You can view the directory here: Online Directory

How long is the course?

Total course time is 8 hours over 18 modules. It is self directed so you are able to break up the time as you see fit.